If you missed this weekend’s Twitter space community drama around Archimedes, (lucky you - it was dumb) I’ve generated a short 5 minute podcast that recaps the whole thing.

I’m constantly experimenting with AI (it’s my job) so I had to create a podcast by running the abstract for Rocket Lab’s Mars Sample Return Program proposal through NotebookLM’s AI audio generator. Check it out

Rocket Lab has been awarded a contract by NASA to provide rapid studies for the Mars Sample Return (MSR) program and the abstract is a fascinating read:

For the last five years, Rocket Lab has methodically implemented a strategy for affordable planetary science that is uniquely suited to deliver a low cost, rapid Mars Sample Return (MSR) mission. As a vertically integrated launch service provider, Rocket Lab has proven capabilities across all required launch vehicle disciplines including vehicle design, production, logistics, regulatory, and operations. Rocket Lab plans to return 30 samples (29 samples tubes and at least 1 witness tube) back to Earth to meet Decadal-class science objectives.

See the whole thing here.

There was a bit of online drama this weekend as some random Twitter user started making unsubstantiated claims about Rocket Lab’s Archimedes development. This is pretty typical of the silly tribalism that defines the space community on Twitter these days but Peter Beck and crew silenced it almost immediately by dropping a long awaited Archimedes video.

Which also led to this informative exchange (for you engine nerds out there):

So, bottom line, engine testing is proceeding well. In fact, I think people are overlooking Rocket Lab’s impressive ability to rapidly iterate here. This highlights comments Beck made earlier about Rocket Lab’s investment in building out mature manufacturing capabilities for Archimedes at the start of its development. That is clearly already paying off.

A reminder that an effective monopoly can exist at the point of invention or market creation but that it will not be allowed to persist.

Competition is a concern when it comes to companies operating in low-Earth orbit, Federal Communications Commissions Chairwoman Jessica Rosenworcel said Wednesday, referring specifically to Starlink, the satellite internet constellation operated by SpaceX and its CEO, Elon Musk.

During a FedScoop-moderated discussion at the Global Aerospace Summit in Washington, D.C., Rosenworcel said that in her time leading the FCC, one thing that’s become clear to her is that “every communications market that has competition is stronger.”

She added, “We see lower prices and more innovation, and honestly, space should be no exception. So we do have one player that’s almost two-thirds of the satellites that are in space right now, and has a very high portion of internet traffic. And the way I see it is, our economy doesn’t benefit from monopolies.”

SpaceX’s Starlink constellation, which now has thousands of satellites in low-Earth orbit, has run into a series of hurdles at the FCC, which oversees satellite licenses and the spectrum the company uses. For example, back in 2022, the agency rescinded a nearly $1 billion subsidy focused on rural broadband. More recently, AT&T and Verizon have raised opposition to waivers, sought by SpaceX and T-Mobile, for out-of-band emissions limits.

Mission name: Kinéis Killed the RadIOT Star

Launch Vehicle: Electron

Launch Site: Launch Complex 1 – Pad A, Mahia, New Zealand

NZST Launch Window: Opens 11:01, September 21, 2024

UTC Launch Window: Opens 23:01, September 20, 2024

ET Launch Window: Opens 19:01, September 20, 2024

PT Launch Window: Opens 16:01, September 20, 2024

Mission Overview: The “Kinéis Killed the RadIOT Star” mission is Rocket Lab’s second dedicated launch for the French Internet of Things (IoT) company Kinéis. Scheduled for launch from Pad A at Rocket Lab’s Launch Complex 1, the mission will deploy five advanced Kinéis nanosatellites into orbit. This is part of a series of five missions designed to complete Kinéis’ full constellation of 25 IoT satellites, aimed at providing global connectivity for data transmission with low energy usage. This launch will mark Rocket Lab’s 53rd Electron mission, bringing their total number of launched satellites to 192.

Press Kit: Press Kit Download

Live Stream: rocketlabusa.com/livestream

For Additional Updates: Follow Rocket Lab’s official Facebook and Twitter accounts.

On September 11, 2023, Kristine Liwag, Executive Director and Head of Aerospace & Defense Equity Research at Morgan Stanley, hosted a discussion with Adam Spice, Chief Financial Officer of Rocket Lab. This conversation took place during Morgan Stanley’s 12th Annual Laguna Conference.

The discussion provided insights into Rocket Lab’s current market position, launch capabilities, and ambitious plans for the future. Spice shared details about the company’s flagship Electron rocket, the development of the new Neutron launch vehicle, and Rocket Lab’s strategies for growth in the competitive space launch and systems market.

Rocket Lab’s Electron is the second most used launch vehicle in the U.S., offering affordable small dedicated launches at around $8 million compared to $40-$50 million for previous competitors in the space.

Rocket Lab is developing Neutron, a new medium-class rocket, to provide an alternative to SpaceX’s Falcon 9, aiming to launch it by mid-2025.

The demand for small dedicated launches is growing, with Rocket Lab having a backlog of over 36 Electrons and planning 15-18 launches this year.

Electron is also being used for hypersonic test campaigns, which is the fastest-growing part of Rocket Lab’s launch portfolio.

Neutron aims to provide a cost-effective and optimized medium-class launch solution, leveraging Rocket Lab’s experience with Electron.

SpaceX currently has a monopoly on medium-class launches, making it uncomfortable for government and commercial customers who need alternatives.

Neutron is designed to offer different payload capacities depending on the mission, with a maximum of 15 tons expendable and 8 tons reusable back to the pad.

Customers face long waiting lists for Falcon 9 launches (up to 2 years), highlighting the need for more launch capacity in the market.

Rocket Lab’s Electron has launched 52 times with a great success rate, and this heritage is expected to help build a healthy backlog for Neutron.

The launch business is very fixed-cost intensive, making launch cadence a critical factor for profitability.

Rocket Lab has the capacity to scale up to a realistic 50 Electron launches per year, with facilities in New Zealand and Virginia.

The market has seen a significant increase in satellite launches, primarily driven by SpaceX’s Starlink, but this has been limited to one provider.

Future opportunities for growth in the launch market include government platforms and new constellations like Amazon’s Kuiper.

Rocket Lab receives most (~90%) of the cash up front before launches, making revenue recognition lumpy but providing financial stability.

The company has seen a steady increase in ASPs from $5 million in 2018 to $8.2 million currently, with production costs decreasing due to efficiencies in BOM, labor hours, and amortization of buildings and machinery.

The company aims to achieve a gross margin of 45-50 points by increasing launch frequency to two per month, with reusability potentially adding 500 basis points of margin improvement.

The switch from helicopter to ocean recovery for rockets was driven by cost and operational efficiency, allowing for more recoverable launches.

Revenue recognition for launches is challenging due to its point-in-time nature, but the company maintains a positive working capital model by collecting most of the cash in advance.

The company anticipates normal lumpiness in revenue due to the dependency on customer payload readiness, which can be delayed by technical issues.

Pricing for Electron rockets has increased to $8.2 million, with limited competition in the small launch market, allowing for potential further price increases.

The company is focusing on volume over maximizing ASP to achieve better margins, aiming for a 40-50% gross margin with Electron launches.

Neutron’s sales strategy differs from Electron’s, with less pricing pressure in the medium launch market, and aims to avoid low-dollar value backlogs.

The space systems business has grown rapidly, becoming a prime contractor for U.S. government missions and developing capabilities for sophisticated spacecraft.

The company’s long-term vision includes deploying its own payloads using Neutron, similar to SpaceX’s model, to create recurring revenue streams.

Neutron is seen as the key enabler for future constellation opportunities, with the company aiming to provide end-to-end solutions from spacecraft design to data management.

The company is open to inorganic growth opportunities in the applications market, leveraging its capabilities to support constellation operators.

I fed Claude Sonnet 3.5 Rocket Lab’s latest earnings presentation and asked it to analyze the results.

Rocket Lab has released its Q2 2024 earnings report, revealing significant growth and progress across multiple fronts. This quarter marks a pivotal moment for the company, demonstrating its increasing prominence in the commercial space sector and its ambitions to become a fully integrated end-to-end space company.

The standout figure from this earnings report is Rocket Lab’s record-breaking quarterly revenue of $106 million. This represents a substantial 71% year-on-year increase and a 15% quarter-on-quarter growth. Such impressive financial performance underscores Rocket Lab’s expanding market share and the increasing demand for its services in both launch and space systems segments.

The company’s backlog, standing at $1.067 billion, further reinforces its strong market position and future revenue potential. This growing backlog, up 5% from the previous quarter, indicates sustained customer interest and confidence in Rocket Lab’s capabilities.

Rocket Lab’s Electron rocket continues to cement its position as the leader in the small launch market. In a year marked by launch anomalies and delays across the industry, Electron has maintained its reliability and launch cadence. The rocket accounted for 64% of all non-SpaceX orbital U.S. launches in 2024 so far, becoming the third most frequently launched rocket globally in 2024.

The company has demonstrated Electron’s versatility and precision through various missions, including back-to-back NASA launches within 11 days, tailored constellation deployments, and complex missions like space debris removal demonstrations. These achievements highlight why satellite operators are willing to pay a premium for Electron’s services.

Rocket Lab has also secured significant new contracts, including a 10-launch agreement with Synspective and multiple launches for other commercial constellation operators. These multi-launch contracts underscore the growing demand for reliable small satellite launch services in the new space economy.

While Electron continues to dominate the small launch market, Rocket Lab is making steady progress on its Neutron rocket, aimed at addressing the medium launch market. The company highlights the strong and growing demand for medium-lift launch services, with projections of over 10,000 satellites needing launch services by 2030 from constellations alone.

Neutron’s development appears to be on a faster timeline compared to other new medium-lift rockets in development. Rocket Lab reports that flight hardware is in production and qualification for 100% of the vehicle. Key milestones include successful hot fire tests of the Archimedes engine, production of structural components, and ongoing construction of launch infrastructure.

The company’s vertical integration strategy is evident in Neutron’s development, with in-house production of major components and the establishment of automated composite production capabilities. This approach could potentially give Rocket Lab a competitive edge in terms of cost and production speed as Neutron enters service.

Rocket Lab’s Space Systems segment is increasingly becoming a major revenue driver for the company. With over $720 million in contract value for satellites in development, production, and operation, this segment is diversifying Rocket Lab’s revenue streams and positioning it as more than just a launch provider.

Notable achievements in the Space Systems segment include:

Completion of twin satellites for NASA’s Mars ESCAPADE mission, showcasing Rocket Lab’s ability to deliver complex spacecraft on time and on budget.

Progress on constellation production for major contracts like Scorpius (18 spacecraft for the Space Development Agency) and Thunder (17 spacecraft buses for Globalstar).

Introduction of the next-generation Advanced Satellite Dispenser (ASD), demonstrating ongoing innovation in satellite deployment technology.

Potential expansion of space solar manufacturing capabilities, supported by proposed federal and state incentives including CHIPS Act funding.

While Rocket Lab’s revenue growth is impressive, the company still faces challenges in achieving profitability. The Q2 report shows a non-GAAP free cash flow of -$28.3 million and an adjusted EBITDA loss of $21.2 million. However, these figures represent only slight increases from the previous quarter, despite significant revenue growth, suggesting improving operational efficiency. Importantly, Rocket Lab maintains a strong liquidity position with $546.8 million in cash, cash equivalents, marketable securities, and restricted cash at the end of Q2 2024.

The company’s Q3 2024 outlook projects continued revenue growth, with expected revenue between $100 million to $105 million. This guidance indicates confidence in sustained demand for both launch and space systems services. With its substantial cash reserves, Rocket Lab appears well-positioned to fund its ongoing operations and strategic initiatives while working towards profitability.

Rocket Lab’s Q2 2024 earnings report showcases a company expertly executing its strategy to become a comprehensive space services provider. By leveraging its proven Electron rocket, making significant strides in the Neutron program, and expanding its space systems capabilities, Rocket Lab is solidifying its position as a key player in the evolving new space industry.

The company’s vertical integration approach is a cornerstone of its success, setting it apart from many competitors. This strategy has enabled Rocket Lab to de-risk its operations across both launch and spacecraft manufacturing. The successful development and testing of the Archimedes engine for Neutron, for instance, demonstrates the company’s ability to innovate and control critical technologies in-house.

Rocket Lab’s focus on both launch and spacecraft manufacturing has created a synergistic ecosystem that enhances its competitive edge. As the demand for space-based services continues to grow, the company is strategically positioned to capture a significant share of this expanding market.

The coming years present exciting opportunities for Rocket Lab as it progresses towards its vision of becoming an end-to-end space company. With each successful Electron launch, advancement in the Neutron program, and expansion of its space systems capabilities, Rocket Lab is systematically reducing risks and strengthening its market position.

For industry observers and investors, Rocket Lab’s progress serves as a compelling example of successful strategic execution in the commercial space sector. The company’s achievements highlight the immense potential in building a comprehensive space services business in the 21st century, showcasing how innovative approaches and vertical integration can drive success in this dynamic industry.

Mission name: A Sky Full Of SARs

Launch Vehicle: Electron

Launch Site: Launch Complex 1, Mahia, New Zealand

NZDT Launch Window: 23:15 AM, Aug 11, 2024

UTC Launch Window: 22:15, Aug 11, 2024

EDT Launch Window: 07:15 PM, Aug 11, 2024

PDT Launch Window: 04:15 PM, Aug 11, 2024

Mission Overview: The mission ‘A Sky Full Of SARs’ involves deploying Acadia-3, a satellite by Capella Space, designed to enhance global SAR imagery capabilities. This marks Rocket Lab’s fifth launch for Capella Space, demonstrating their ongoing collaboration in improving Earth observation technologies.

Press Kit: Download PDF

Live Stream: rocketlabusa.com/livestream

For more detailed information, visit Rocket Lab’s mission page.

Mission name: Owl For One, One For Owl

Launch Vehicle: Electron

Launch Site: Launch Complex 1

UTC Launch Window: 16:15, Aug 3, 2024

NZDT Launch Window: 04:15, Aug 2, 2024

EDT Launch Window: 12:15, Aug 2, 2024

PDT Launch Window: 09:15, Aug 2, 2024

Mission Overview: Rocket Lab is scheduled to launch the StriX satellite for Synspective, which aims to detect millimeter-level changes on Earth’s surface using SAR technology. The mission includes an advanced mid-mission maneuver to protect the satellite from solar radiation.

Live Stream: rocketlabusa.com/livestream

For more information, check out Rocket Lab’s next mission page.

Peter Beck just shared an update on the company’s progress with Archimedes. The tweet provides a glimpse into the intricate and methodical process that precedes a full stage hot fire. This milestone underscores Rocket Lab’s commitment to precision engineering and the challenges inherent in developing reliable rocket propulsion systems.

As Beck’s tweet reveals, Rocket Lab has successfully completed a pre burner ignition and run. This phase involves the initial ignition of the engine’s pre burner, a critical component responsible for driving the turbopumps that feed propellants into the main combustion chamber. The successful ignition indicates that the pre burner is functioning correctly, a foundational step in the overall engine testing sequence.

The next phase focuses on tuning the propellant timings. This process, expected to take a week or more, involves adjusting the precise moments when propellants are introduced and ignited within the engine. These adjustments are crucial for ensuring that the engine operates efficiently and safely. The sensitivity of these timings to start-up transients and other variables necessitates meticulous attention to detail and extensive testing.

Beck emphasizes the engine’s sensitivity to start-up transients—rapid changes in conditions that occur when the engine starts. These transients can significantly impact the performance and stability of the engine. Understanding and mitigating their effects is essential for achieving a smooth and reliable engine start-up.

Characterizing these transients involves detailed measurements and analysis of various parameters, including pressure, temperature, and flow rates. Engineers use this data to refine the engine’s design and control systems, ensuring that it can handle the dynamic conditions of start-up and operation.

The ultimate goal of this testing phase is to conduct a full stage run, where the main valves are opened, and the engine operates at its full capacity. This stage is critical for verifying the engine’s performance under real-world conditions and ensuring that it meets all design specifications.

Achieving this milestone requires a comprehensive understanding of the engine’s behavior across a range of operating points. This includes not only start-up transients but also steady-state operation and response to various control inputs. The characterization process, therefore, involves extensive data collection and iterative testing to fine-tune the engine’s performance.

Rocket engine development is a complex and iterative process that requires a deep understanding of fluid dynamics, thermodynamics, and materials science. Each component of the engine must be carefully designed and tested to ensure that it can withstand the extreme conditions of rocket propulsion.

Rocket Lab’s approach, as evidenced by Beck’s update, highlights the importance of systematic testing and refinement. By focusing on detailed characterization and tuning, the team ensures that each phase of development builds on a solid foundation of validated performance.

Rocket Lab’s recent progress in pre burner ignition and tuning marks a significant step towards achieving a full stage run. The detailed and methodical approach to engine development underscores the complexities involved and the importance of precision in rocket propulsion systems. As the team continues to refine their engine, they move closer to realizing their goal of reliable and efficient Neutron launch capabilities.

This tweet from Peter Beck indicates that Rocket Lab has successfully completed ignition system tests as they close in on a full hot fire of Archimedes. This is an important step in Archimedes' development process, as the ignition system is a critical component that must function reliably to ensure a successful engine test.

Based on the information provided, it seems the team is making steady progress towards their goal of a hot fire test. A recent tweet by Jeff Foust suggests that it could occur in the next ten days or so. The successful ignition system tests are a positive sign, as they demonstrate the team’s ability to integrate and validate key subsystems of the rocket engine.

The fact that the last two testing images shared by the team were taken at night suggests the team has been working around the clock to advance their progress. This level of dedication and commitment is crucial in the fast-paced world of rocket development, where every minute counts towards achieving key milestones.

…offers the first in-depth examination of the current incarnation of the space race by focusing on Rocket Lab, Astra Space and Planet Labs and the people behind the companies. It’s an unfiltered look at why making rockets is so hard, the wonders and perils of satellites and why low-Earth orbit is so important to our modern economies and ways of life.

The trailer has already given us this gem:

I’m not sure how much unfiltered Peter Beck is in the film, but I’m ready for whatever it has to offer.

Last night, Firefly Aerospace successfully launched its Alpha rocket on the “Noise of Summer” mission from Vandenberg Space Force Base. The launch, which occurred at 9:04 PM PDT, marked a significant milestone for Firefly as it successfully deployed eight CubeSats into low Earth orbit. The payloads included CubeSats from various institutions such as the University of Maine, University of Arizona, NASA Johnson Space Center, and University of Washington. Notable satellites include the CatSat, which will demonstrate an inflatable antenna for high-speed communications, and the SOC-i, a technology demonstration mission focusing on advanced attitude control.

I asked both Claude 3.5 and ChatGPT to weigh in on this and this is what they had to say:

The “spin primes” phase is an important step in rocket engine testing, occurring before full hot fire tests. It’s part of the preparatory stages leading up to a complete engine firing. Here’s a brief overview:

Purpose: Spin primes test the turbopumps that deliver propellants to the combustion chamber. The pumps are spun up without igniting the engine.

Process: Propellants flow through the system, but at lower pressures and temperatures than a full hot fire. This checks for proper operation of valves, seals, and pumps.

Position in testing sequence:

Proximity to hot fire: Spin primes are typically conducted days or weeks before the first hot fire test, depending on the testing schedule and results.

Spin primes are crucial for verifying system readiness and identifying potential issues before progressing to more demanding and risky hot fire tests. They help ensure the propellant delivery system functions correctly under more realistic conditions.

The “spin primes” phase is a critical step in the testing process of rocket engines. This phase involves spinning the engine’s turbo pumps to ensure they are functioning correctly and can achieve the necessary speed and pressure to deliver fuel and oxidizer to the combustion chamber. Here’s a breakdown of its place in the overall testing process and its proximity to the hot fire test:

Component Testing: Individual components of the engine, such as the turbo pumps, injectors, and combustion chambers, are tested to ensure they work correctly on their own.

Assembly and Integration: The tested components are assembled into a complete engine. Integration checks are conducted to ensure everything fits and works together as expected.

Cryogenic Testing: The engine is tested with cryogenic fluids to check for leaks, proper flow rates, and the correct operation of components at extremely low temperatures.

Spin Primes: The turbo pumps are spun up to operational speeds without igniting the engine. This test ensures that the pumps can reach the required speed, generate the necessary pressure, and operate smoothly. It also checks for any anomalies that might occur during pump operation.

Wet Dress Rehearsal: The engine is loaded with fuel and oxidizer, and the systems are put through a full operational cycle without actually igniting the engine. This step ensures that all systems are ready for a hot fire test.

Hot Fire Test: The engine is ignited and run at full operational conditions. This is the critical test that demonstrates the engine’s performance and reliability under actual operating conditions.

The spin primes phase is one of the final steps before the hot fire test. It is usually conducted shortly before the wet dress rehearsal and the hot fire test. The successful completion of spin primes indicates that the engine’s turbo pumps are functioning correctly and the system is close to being ready for a hot fire test. Typically, only a few tests remain after spin primes, making it a significant milestone in the overall testing process.

In summary, spin primes are crucial for validating the turbo pumps' functionality and are one of the last steps before the hot fire test, indicating that the engine is nearly ready for a full operational test.

Developing a rocket engine that’s ready for large-scale production is significantly more demanding than creating and firing a test article. While both processes are crucial in rocket development, the leap from prototype to production introduces a host of new challenges. Let’s explore why:

Test articles are often built using specialized, sometimes even:

In contrast, production engines must be designed with mass manufacturing in mind. This fundamental shift introduces several complex challenges:

This transition from specialized, low-volume production to mass manufacturing represents a significant engineering and logistical challenge. It requires not only a redesign of the engine itself but also the development of an entire ecosystem of cutting-edge processes, advanced tools, and specialized partnerships to support large-scale production while maintaining the high standards of quality and reliability demanded by the aerospace industry.

A test firing can be considered successful even with minor issues. Production engines, however, must perform consistently over multiple flights. This demands:

While cost is less of a concern for prototypes, production engines must be economically viable. This involves:

Test articles may operate under special exemptions, but production engines must meet stringent safety and environmental regulations. This requires:

Unlike test articles, production engines must be designed for longevity and ease of maintenance. This includes:

Production engines must seamlessly integrate with other rocket systems and ground support equipment. This necessitates:

While test articles may operate under controlled conditions, production engines must function reliably in a variety of environments. This requires:

Unlike a test article, which may be a one-off design, production engines are expected to evolve and improve over time. This involves:

In conclusion, while building and firing a test article is an impressive feat in itself, transitioning to a production-ready rocket engine introduces a new level of complexity. It requires not just engineering expertise, but also a deep understanding of manufacturing processes, regulatory environments, and long-term operational considerations. This challenging process is what separates experimental rockets from those capable of reliable, repeated launches – a crucial step in advancing space exploration and commercialization.

This post at The War Zone highlights the transformative impact of space-based assets on modern warfare, as demonstrated by Ukraine’s use of a crowd-funded ICEYE satellite. Over the past two years, this single satellite, along with access to dozens more, has enabled Ukraine to identify and destroy more than 1,500 Russian targets worth billions of dollars. The satellite’s synthetic aperture radar technology allows for all-weather, day-and-night imaging, piercing through camouflage and cloud cover to reveal enemy positions, equipment, and infrastructure. This capability has dramatically enhanced Ukraine’s ability to conduct precision strikes and gather critical intelligence, showcasing how access to space-based reconnaissance can level the playing field in asymmetric conflicts. The success of this program underscores the growing importance of space assets in modern warfare, not just for major powers but also for smaller nations and even non-state actors who can now leverage commercial satellite technology to gain significant tactical and strategic advantages.

Even as Rocket Lab prepares to launch its new medium-class rocket, Neutron, the smaller Electron launcher will continue to play a crucial role in the company’s strategy. Here’s why:

Market Segmentation: Neutron is designed to complement Electron, not replace it. While Neutron will handle larger payloads, Electron will continue serving the small satellite market.

Growing Small Satellite Demand: The increasing need for small satellite launches aligns perfectly with Electron’s capabilities, ensuring its ongoing relevance.

Precision and Flexibility: Electron’s ability to provide dedicated launches to precise orbits on customer-defined schedules remains a valuable asset, particularly for small satellite operators.

Proven Track Record: With nearly 50 successful launches, Electron has established a reputation for reliability and performance that customers trust.

Cost-Effectiveness: For smaller payloads, Electron is likely to remain more economical than its larger counterpart.

Rapid Launch Capabilities: Electron’s frequent launch schedule and multiple launch sites, including Rocket Lab’s private facility in New Zealand, offer unique advantages.

Vertical Integration: Rocket Lab’s end-to-end space solutions benefit from having both Electron and Neutron available, catering to a wider range of customer needs.

Complementary Roles: Rocket Lab envisions a future where both rockets contribute equally to their launch business, with Neutron splitting its missions between customer payloads and the company’s own satellites.

Electron and Neutron are positioned to serve different segments of the launch market. This dual-rocket strategy allows Rocket Lab to offer a comprehensive range of services, maintaining its competitive edge in the dynamic space industry.

An interesting quote from Peter Beck’s most recent interview with NZ Herald senior business journalist Madison Reidy:

“If you’re in the commercial telecoms business from space, you’re in a very difficult spot right now because it’s impossible to keep up with the ability for someone to build their own rocket and launch it whenever they need to launch it and deploy that service.”

Something to think about as we wait for Rocket Lab to reveal their constellation plans.

In the dynamic world of aerospace, strategic pivots are often necessary to align with market demands and technological advancements. Rocket Lab’s recent decision to deprioritize the reusability of its Electron rockets in favor of accelerating the development of the Neutron medium rocket is a prime example of such a strategic shift. As Rocket Lab CEO Peter Beck candidly noted in a recent interview with Payload, “The most important thing is to not interrupt the production team with new things and just keep the production rate of Electron where it needs to be to support the manifest best this year. Electron reuse is not that important to the business on a margin standpoint, or at this point, even from a technology standpoint. The reusability team and the recovery team are 100% directed and focused on other things, mainly Neutron, of course”.

Market Demand and Profit Margins: Electron rockets, while successful, primarily serve the small satellite launch market. This market, though vital, offers limited profit margins compared to the burgeoning demand for medium-lift capabilities. Neutron, designed to cater to the medium-lift market, is set to unlock significant revenue streams. By accelerating Neutron’s development, Rocket Lab is positioning itself to capture a more substantial share of this lucrative market, which is essential for long-term growth and sustainability.

Technological Advancements: The focus on Electron reusability, though innovative, does not present immediate technological or financial advantages. As stated, reusability in the Electron program is not critical from a margin or technology standpoint. Instead, resources and efforts are better invested in perfecting the Neutron rocket, which promises more considerable advancements and benefits for the company’s portfolio.

Team Focus and Efficiency: Rocket Lab’s reusability and recovery teams are now dedicated entirely to the Neutron project. This focused approach ensures that the company’s top talent and resources are utilized efficiently, driving faster and more effective development cycles. The shift in focus means less interruption to the Electron production team, allowing them to maintain optimal production rates and support existing launch manifests without additional strain.

Rocket Lab’s strategy underscores the importance of adaptability in the aerospace sector. By prioritizing the Neutron rocket, Rocket Lab is not only responding to market needs but also paving the way for future technological advancements and business growth. This decision is a testament to Rocket Lab’s forward-thinking approach and its commitment to staying ahead in a competitive industry.

Despite this shift in focus, it’s important to acknowledge the significant progress Rocket Lab has already made toward Electron reusability. The strides they have taken in this area ensure that when the time comes to revisit Electron reusability post-Neutron, it should be a relatively straightforward process. The foundation laid so far will allow Rocket Lab to efficiently integrate reusability features into the Electron program without substantial delays or resource reallocation.

In conclusion, Rocket Lab’s move to prioritize Neutron over Electron reusability makes perfect sense. It aligns with market opportunities, leverages technological advancements, and ensures efficient use of resources. As the space industry continues to evolve, Rocket Lab’s strategic pivot positions it well for continued success and innovation, with the flexibility to return to and capitalize on Electron reusability in the future.

Rocket Lab has announced a significant expansion of its partnership with Japanese Earth observation company Synspective, signing a contract for ten dedicated Electron rocket launches between 2025 and 2027. This agreement, the largest in Rocket Lab’s history, will support the growth of Synspective’s StriX constellation of synthetic aperture radar (SAR) satellites.

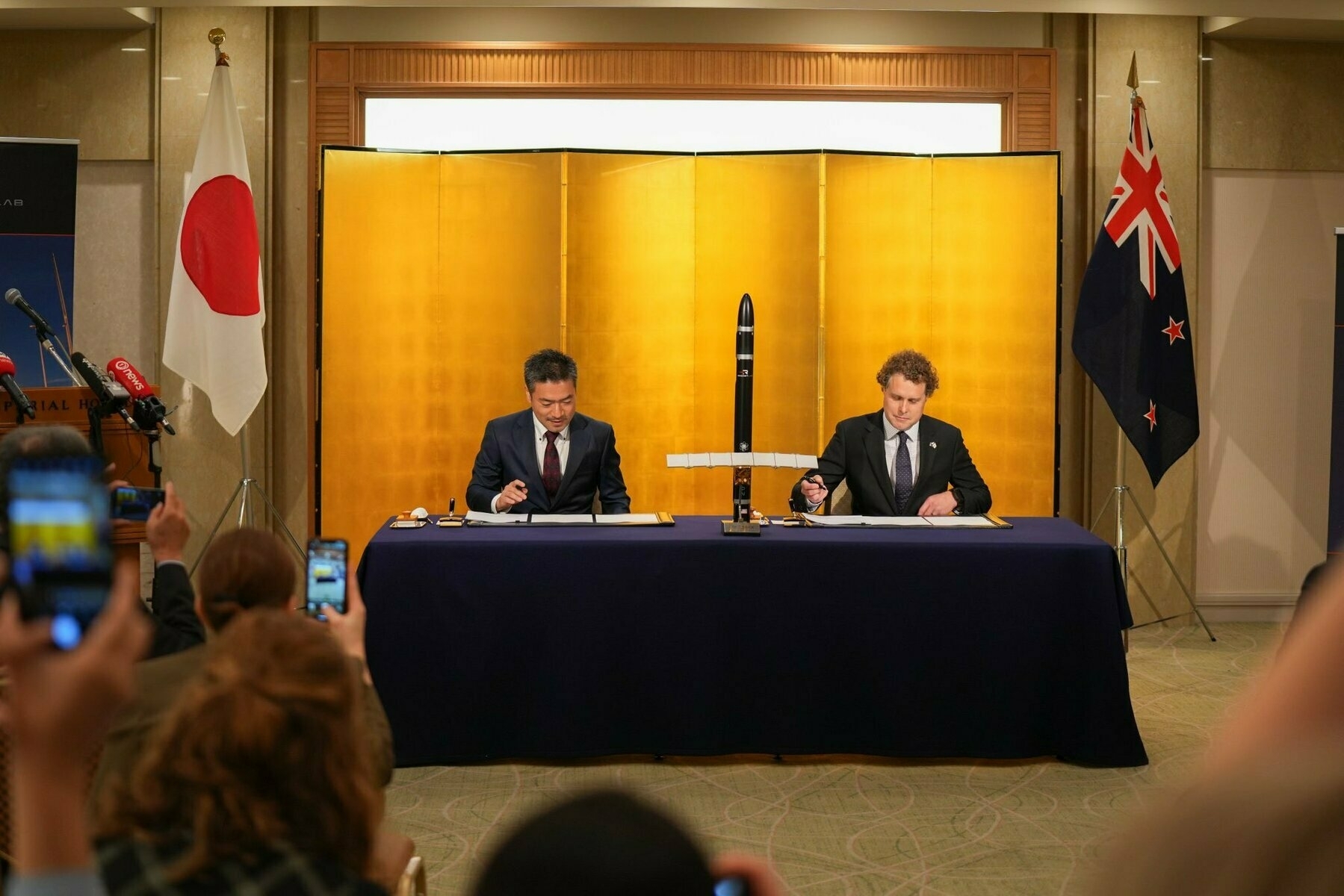

The deal was unveiled at an event in Tokyo, attended by key executives from both companies and New Zealand Prime Minister Christopher Luxon, who highlighted the importance of international collaboration in driving the global space industry forward. Synspective’s StriX satellites are designed to collect high-resolution imagery of Earth’s surface, capable of detecting millimetre-level changes day or night and through any weather conditions. By launching on dedicated Electron missions, Synspective will have greater control over their launch schedule and orbital placement, ensuring optimal coverage and performance for their constellation.

The new multi-launch agreement builds upon an already strong partnership between Rocket Lab and Synspective. Rocket Lab has served as a dedicated launch provider for Synspective since 2020, having successfully deployed four StriX satellites across four missions to date, with two more launches planned for this year from Launch Complex 1 in New Zealand.

This landmark deal not only demonstrates the rapid growth of Japan’s space industry but also underscores the increasing demand for tailored small satellite launch services. Rocket Lab’s Electron rocket, manufactured in the USA and launched from New Zealand, provides a unique and flexible solution for companies like Synspective looking to build out their satellite constellations efficiently. As Synspective continues to expand its StriX constellation and its Earth observation capabilities, this long-term partnership with Rocket Lab will play a crucial role in enabling the company to scale its operations and deliver valuable data and insights to its customers.

Launch 45 | 13 March 2024

Launch 30 | 15 September 2022

Launch 24 | 28 February 2022

Launch 17 | 15 December 2020

Mission name: No Time Toulouse

Launch Vehicle: Electron

Launch Site: Launch Complex 1 – Pad B, Mahia, New Zealand

NZST Launch Window: Opens 06:13, June 21, 2024

UTC Launch Window: 18:13, June 20, 2024

ET Launch Window: 14:13, June 20, 2024

PT Launch Window: 11:13, June 20, 2024

Mission Overview: ‘No Time Toulouse’ is a dedicated mission for the French Internet of Things (IoT) company Kinéis. This mission will deploy five IoT satellites to a 635 km orbit, marking Rocket Lab’s milestone 50th Electron rocket launch. The mission is the first of five dedicated launches for Kinéis to deploy a total of 25 satellites.

Press Kit: Press Kit Download

Live Stream: rocketlabusa.com/livestream

For Additional Updates: Follow Rocket Lab’s official Facebook and Twitter accounts.

Rocket Lab is now just days away from its 50th Electron launch. Designed to deliver payloads of up to 300 kg (661 lbs) to low Earth orbit, the Electron caters to the growing demand for small satellite launches. Achieving flexibility and innovation in a small launch vehicle is particularly challenging, often more so than with larger class launchers. Electron represents several groundbreaking innovations, and in recent years, Rocket Lab has made significant strides toward making the Electron partially reusable and adaptable for critical national security missions, solidifying its position at the forefront of the space industry.

A cornerstone of Rocket Lab’s innovation is the Rutherford engine. These engines are entirely 3D-printed, which allows for rapid manufacturing and cost reduction. The use of 3D printing technology enables the creation of complex geometries that would be difficult or impossible to achieve with traditional manufacturing methods. This innovation has significantly reduced the time and cost of engine production, making the Electron rocket both efficient and economical.

The Rutherford engines also feature electric turbopumps, a groundbreaking innovation in rocket design. Traditional rocket engines use gas-powered turbopumps to feed propellant to the combustion chamber. Rocket Lab has replaced these with battery-powered electric motors, simplifying the engine design and reducing costs. This unique approach allows for more precise control over the fuel flow and is the first instance of electric turbopumps being used in an orbital-class rocket.

The Electron rocket’s structure is made primarily of carbon composite materials. This lightweight yet strong material allows for significant weight reduction, increasing the rocket’s payload capacity. The use of carbon composites also streamlines the manufacturing process, as the rocket’s body can be fabricated in just two pieces. This material choice is crucial for reusability, as it enhances the durability and resilience of the rocket’s components.

The unique Photon kick stage is designed to provide precise orbital insertion for payloads, offering greater flexibility in mission design. This stage also serves as a platform for Rocket Lab’s own satellite missions. While not directly related to reusability, the Photon kick stage demonstrates Rocket Lab’s commitment to innovation and mission adaptability, which are essential for a sustainable and reusable launch system.

A significant milestone in Rocket Lab’s path to reusability was the successful reuse of a Rutherford engine. By recovering and refurbishing the engine from a previous mission, Rocket Lab demonstrated that critical components of the Electron rocket could be reused, paving the way for more sustainable and cost-effective launches.

The most critical step toward reusability has been the development of techniques for recovering the Electron’s first stage. Rocket Lab has successfully demonstrated the ability to recover the first stage using parachutes and ocean retrieval. This method, tailored for small launch vehicles, aims to significantly increase launch frequency and lower costs for customers.

An additional demonstration of Rocket Lab’s innovation and flexibility is the development of the High-Altitude Suborbital Testbed (HASTE). HASTE represents Rocket Lab’s ability to adapt and expand its technology for a variety of missions, providing a platform for high-altitude research and development. This testbed allows for rapid iteration and testing of new technologies, further enhancing Rocket Lab’s capabilities in the space industry.

Rocket Lab’s focus on innovation with the Electron rocket is crucial for the growing small satellite market. By integrating advanced technologies, reducing launch costs, increasing payload capacity, and offering greater mission flexibility, Rocket Lab continues to create new opportunities for satellite operators and researchers. As the demand for small satellite launches continues to grow, Rocket Lab’s advancements will play a key role in enabling a critical element of the space industry.

Stoke Space recently achieved a significant milestone by completing the first successful hot-fire test of their full-flow, staged-combustion (FFSC) rocket engine. Conducted on June 5, 2024, at their test site in Moses Lake, Washington, this engine is set to power the first stage of their fully reusable Nova medium-lift launch vehicle.

The test demonstrated the engine’s ability to ramp up to its target starting power level, producing the equivalent of 350,000 horsepower in less than one second. This FFSC engine, known for its high efficiency and performance, is designed to generate over 100,000 pounds of thrust at full power.

Stoke Space plans to continue refining the engine and vehicle design throughout 2024, with a targeted orbital test flight in 2025. This achievement follows their successful vertical takeoff and landing test of the second stage in September 2023, indicating rapid progress in their mission to create fully reusable rockets.

Due to the sensitive nature of their missions Rocket Lab HASTE launches don’t get much fanfare, but they can’t launch in complete secrecy because NOTAMS and maritime notices are still required. So given that, could low-key notices about unnamed sounding rocket launches refer to HASTE? Maybe…

Sounding rockets, often referred to as research rockets, play a crucial role in space exploration. These suborbital rockets are designed to carry scientific instruments to the upper atmosphere and near space. They provide a cost-effective and efficient means for scientists to conduct experiments and gather data from altitudes ranging between 50 to 1,500 kilometers above the Earth’s surface. This blog post delves into the world of sounding rockets and explores whether Rocket Lab’s HASTE (Hypersonic Accelerator Suborbital Test Electron) could be classified as one.

Sounding rockets are designed for scientific research and technological testing. Unlike orbital rockets that transport payloads into orbit, sounding rockets follow a suborbital trajectory, reaching the edge of space and then descending back to Earth. This trajectory allows for short-duration missions, typically lasting from a few minutes to over an hour.

Key characteristics of sounding rockets include:

Sounding rockets are used for various scientific and technological purposes, including:

Rocket Lab, a prominent aerospace company, has developed a suborbital launch vehicle named HASTE (Hypersonic Accelerator Suborbital Test Electron). While Rocket Lab is primarily known for its orbital launch services, HASTE is specifically designed for suborbital missions, raising the question of whether it can be considered a sounding rocket.

Key Features of HASTE:

Given these characteristics, HASTE shares several fundamental aspects with traditional sounding rockets. Its suborbital nature, flexibility in payload accommodation, and focus on scientific and technological testing align well with the typical use cases of sounding rockets.

Sounding rockets remain an essential tool in the arsenal of space exploration and research. They provide a unique platform for conducting experiments in the upper atmosphere and near space, offering cost-effective and timely access to scientific data. Rocket Lab’s HASTE, with its suborbital trajectory and versatility, can indeed be considered a modern sounding rocket, bridging the gap between traditional research rockets and advanced hypersonic testing platforms.

As the field of space exploration continues to evolve, sounding rockets like HASTE will play a pivotal role in advancing our understanding of the universe and developing cutting-edge technologies for future missions. Whether for atmospheric research, technology testing, or hypersonic experiments, the legacy of sounding rockets continues to propel humanity’s quest for knowledge and innovation.