I fed Claude Sonnet 3.5 Rocket Lab’s latest earnings presentation and asked it to analyze the results.

Rocket Lab has released its Q2 2024 earnings report, revealing significant growth and progress across multiple fronts. This quarter marks a pivotal moment for the company, demonstrating its increasing prominence in the commercial space sector and its ambitions to become a fully integrated end-to-end space company.

Record-Breaking Revenue and Growth

The standout figure from this earnings report is Rocket Lab’s record-breaking quarterly revenue of $106 million. This represents a substantial 71% year-on-year increase and a 15% quarter-on-quarter growth. Such impressive financial performance underscores Rocket Lab’s expanding market share and the increasing demand for its services in both launch and space systems segments.

The company’s backlog, standing at $1.067 billion, further reinforces its strong market position and future revenue potential. This growing backlog, up 5% from the previous quarter, indicates sustained customer interest and confidence in Rocket Lab’s capabilities.

Electron: Dominating Small Launch Market

Rocket Lab’s Electron rocket continues to cement its position as the leader in the small launch market. In a year marked by launch anomalies and delays across the industry, Electron has maintained its reliability and launch cadence. The rocket accounted for 64% of all non-SpaceX orbital U.S. launches in 2024 so far, becoming the third most frequently launched rocket globally in 2024.

The company has demonstrated Electron’s versatility and precision through various missions, including back-to-back NASA launches within 11 days, tailored constellation deployments, and complex missions like space debris removal demonstrations. These achievements highlight why satellite operators are willing to pay a premium for Electron’s services.

Rocket Lab has also secured significant new contracts, including a 10-launch agreement with Synspective and multiple launches for other commercial constellation operators. These multi-launch contracts underscore the growing demand for reliable small satellite launch services in the new space economy.

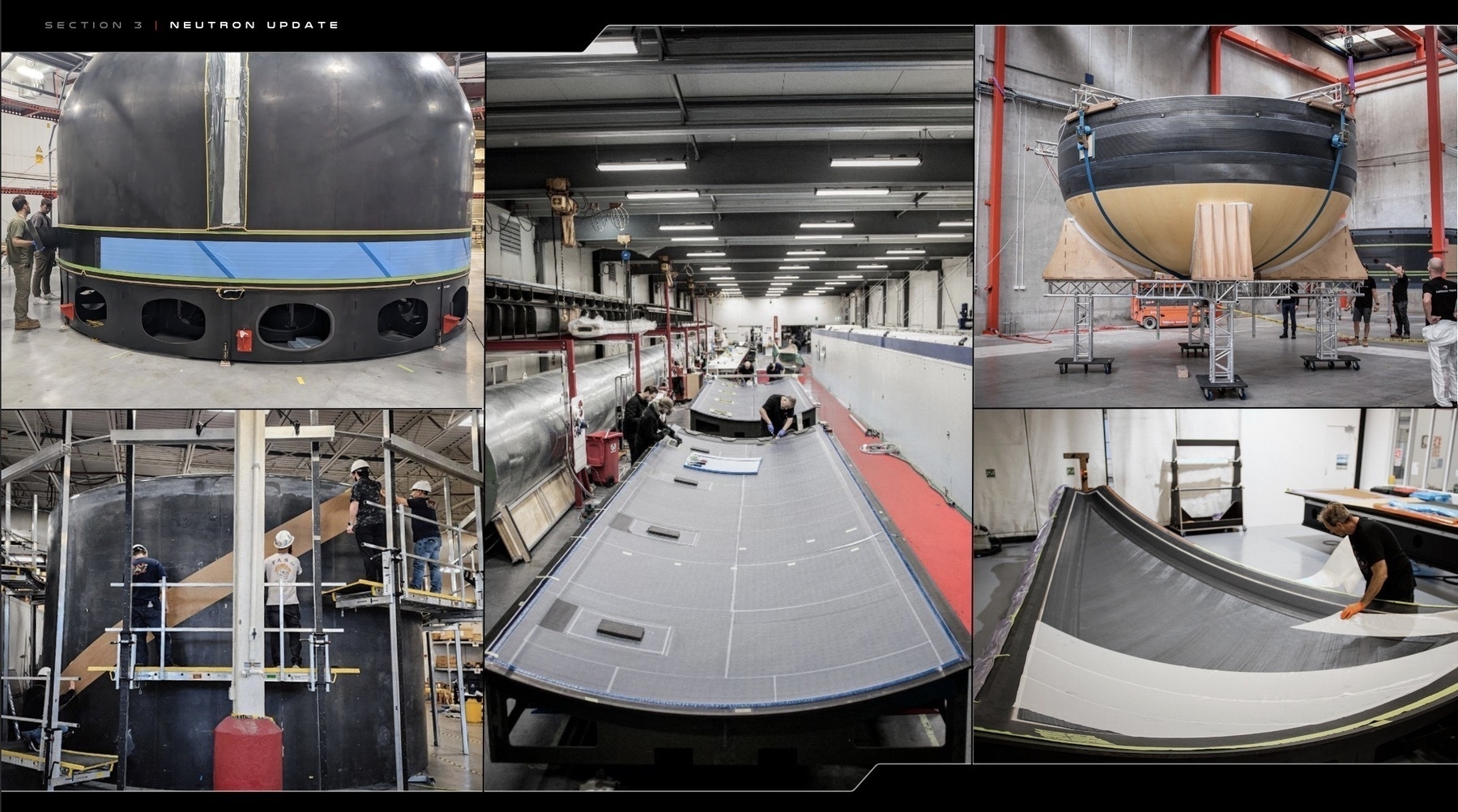

Neutron: Progress Towards Medium-Lift Capabilities

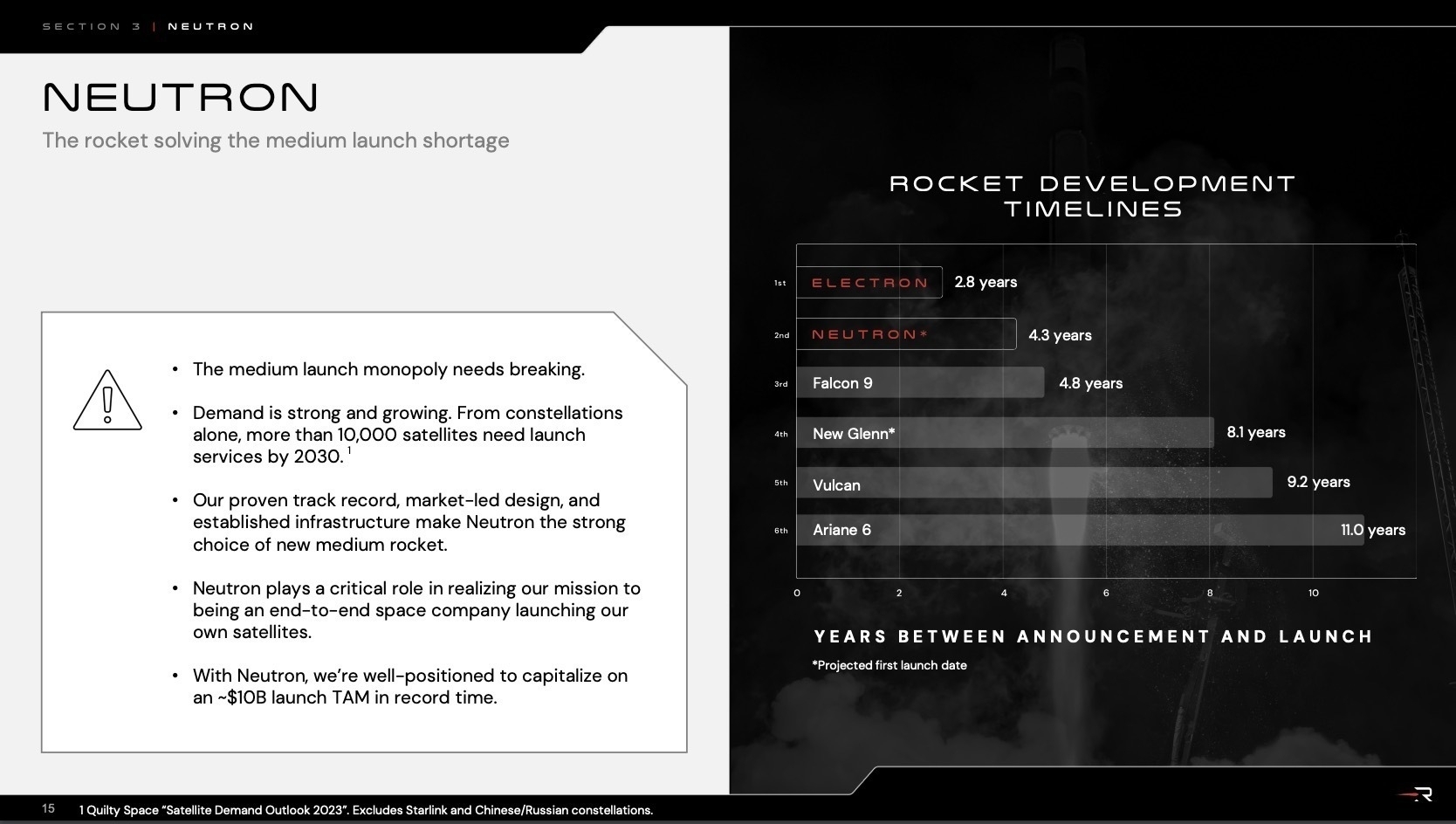

While Electron continues to dominate the small launch market, Rocket Lab is making steady progress on its Neutron rocket, aimed at addressing the medium launch market. The company highlights the strong and growing demand for medium-lift launch services, with projections of over 10,000 satellites needing launch services by 2030 from constellations alone.

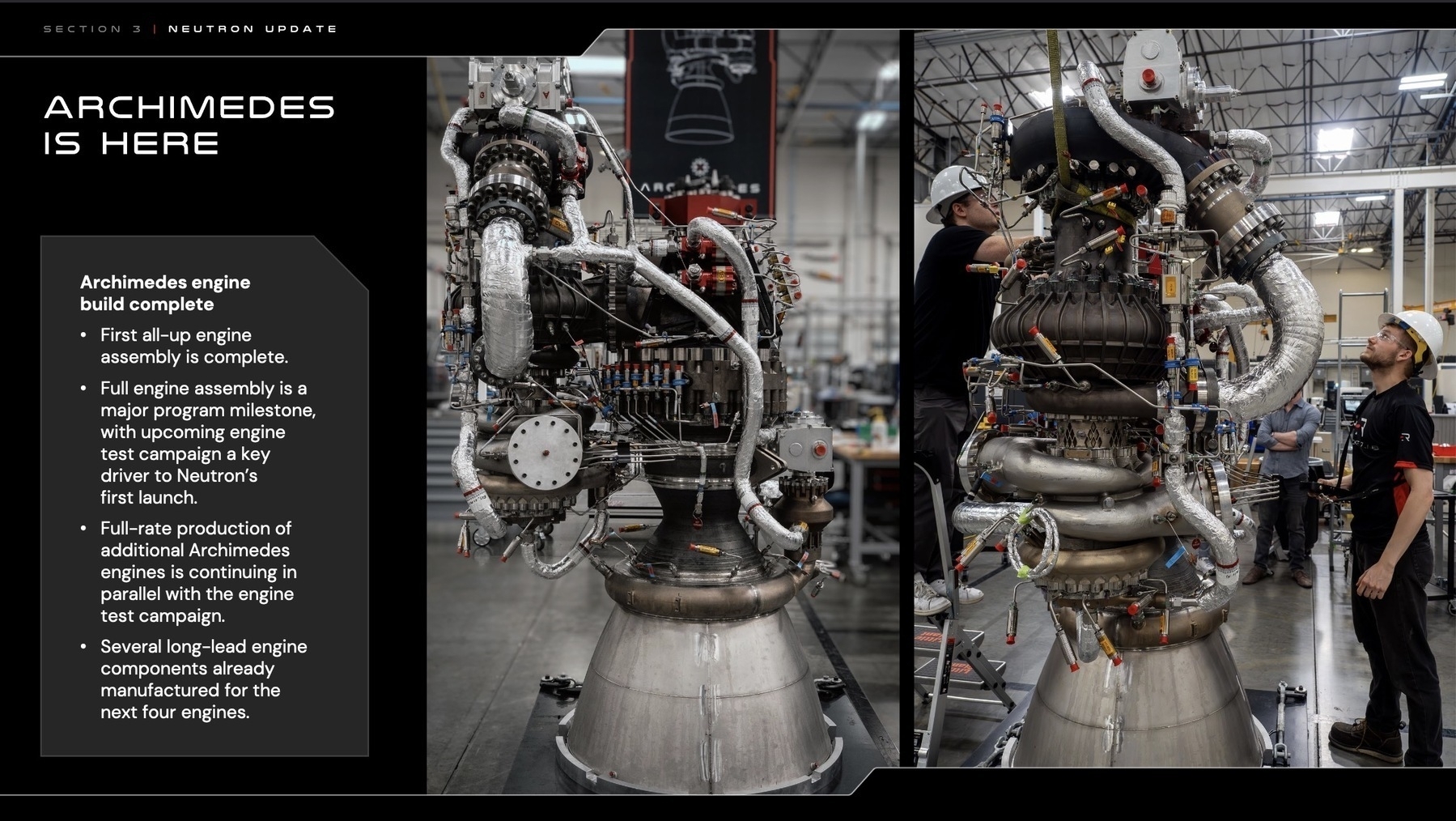

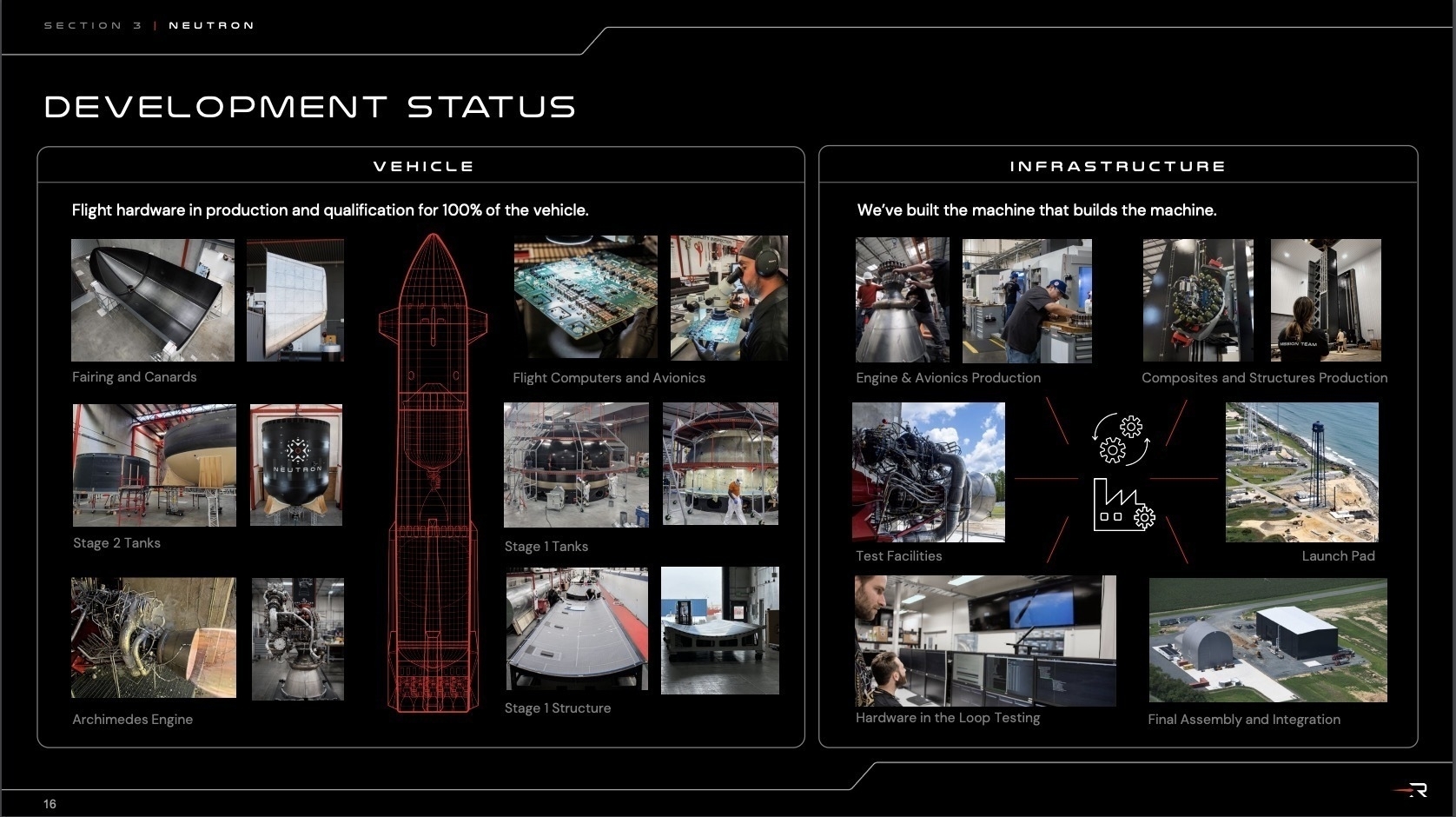

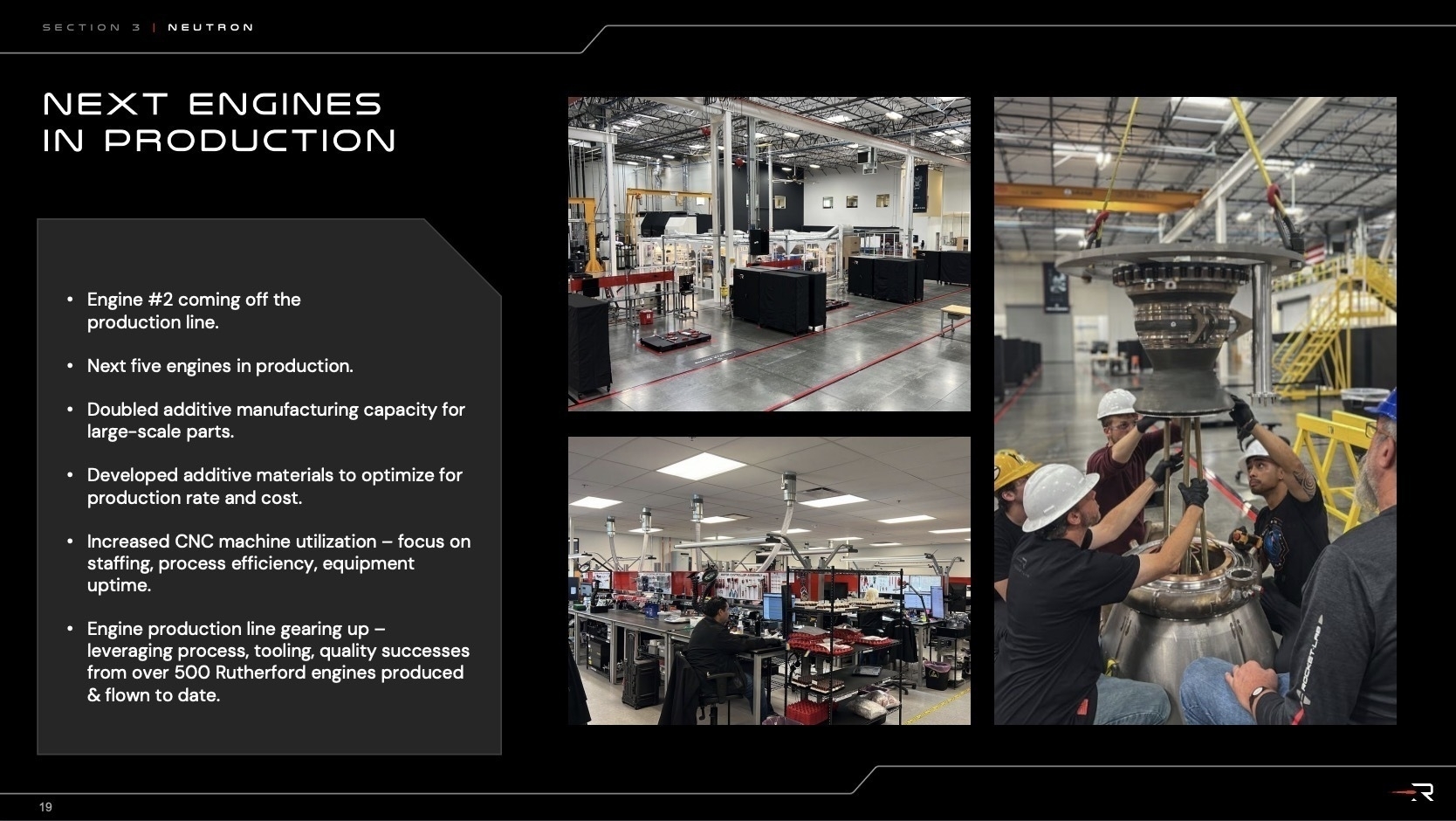

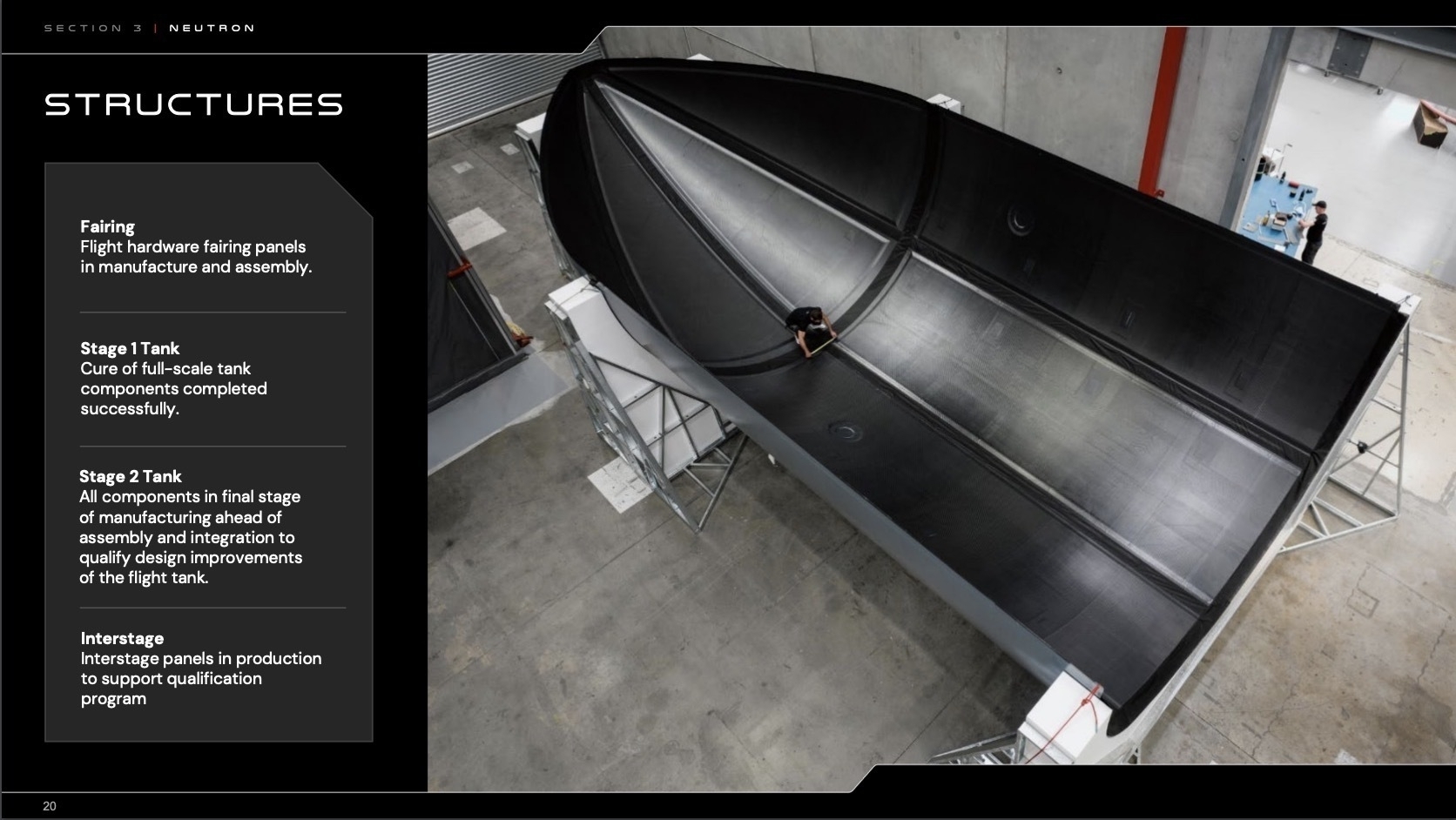

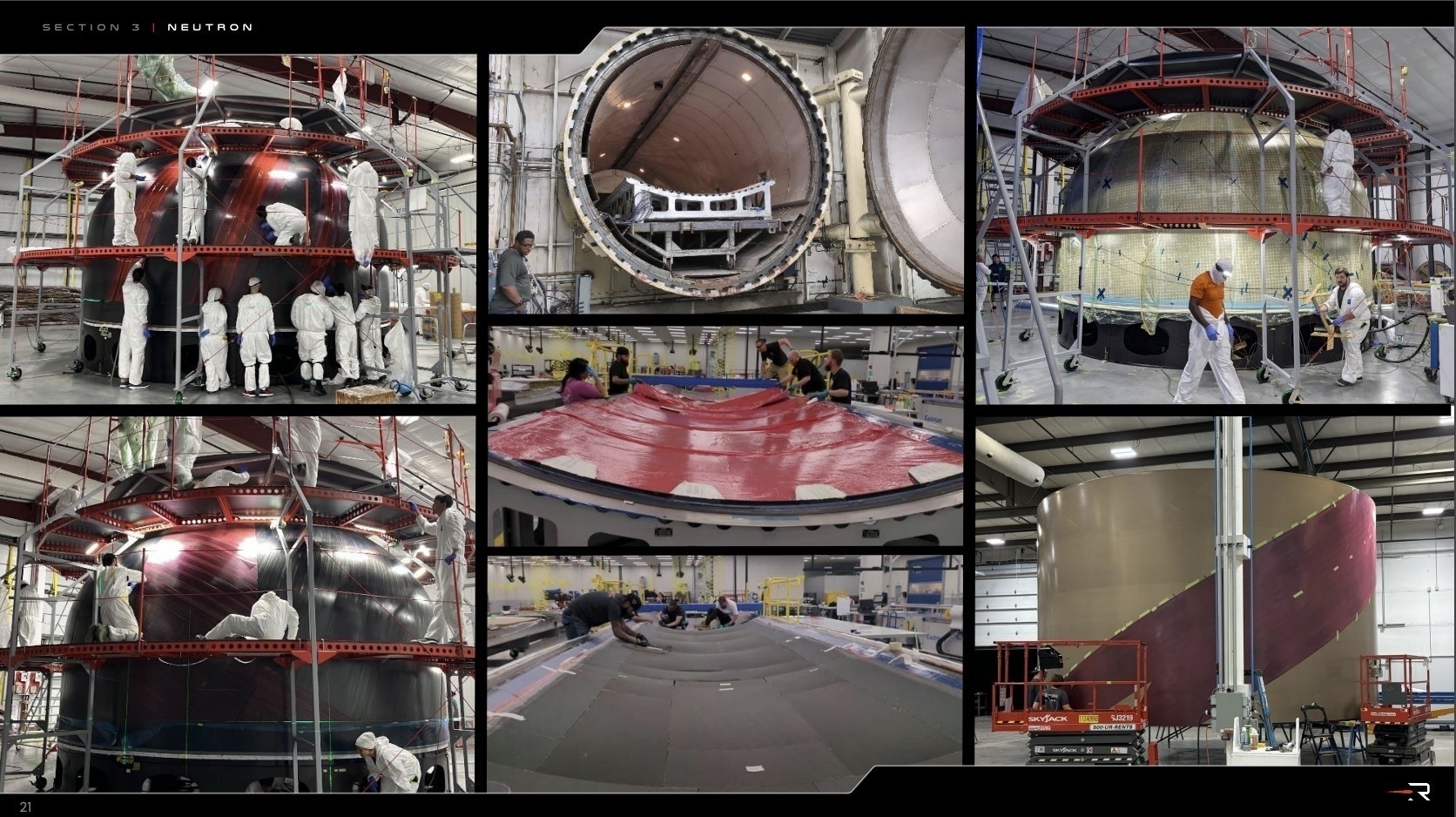

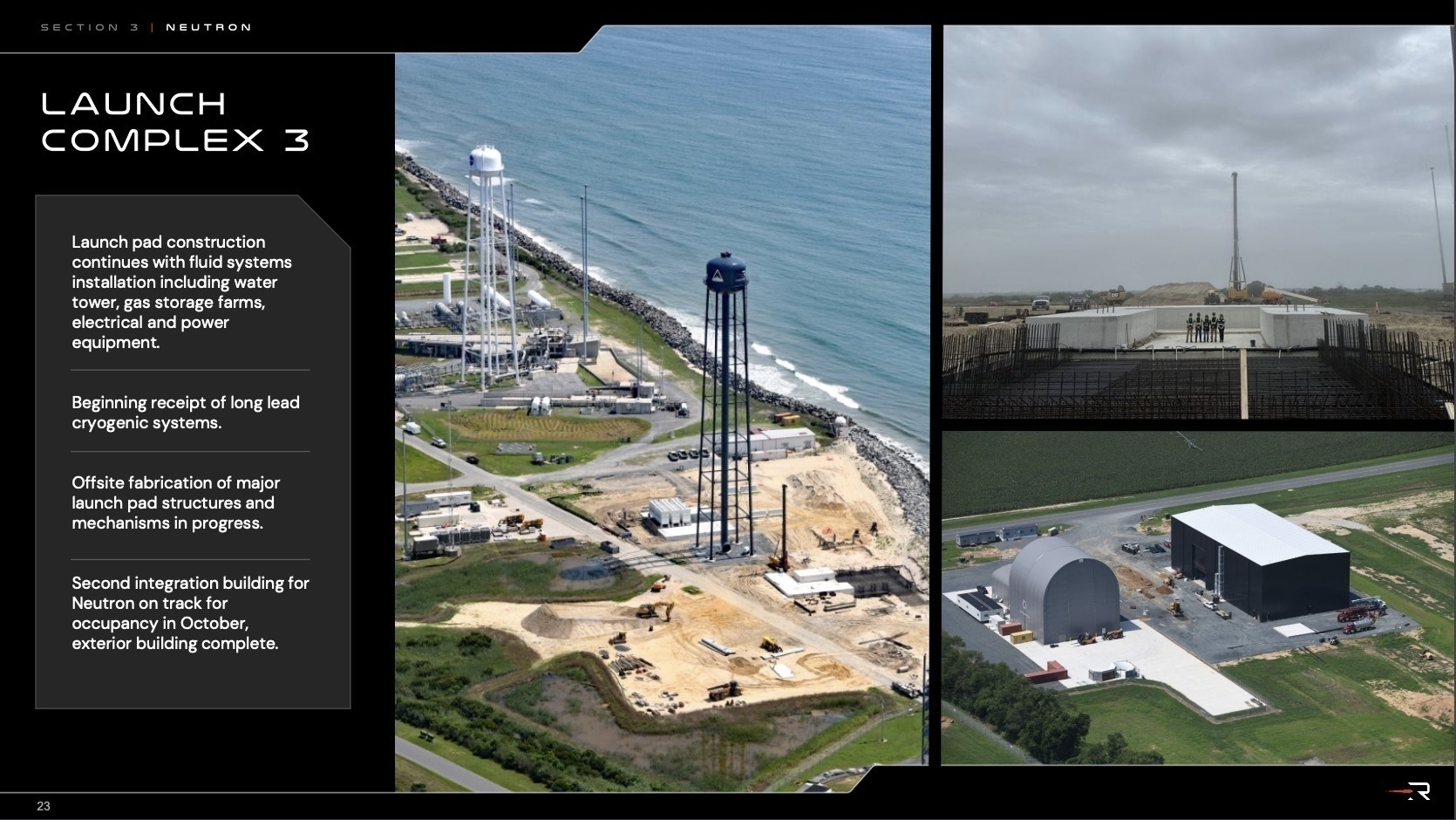

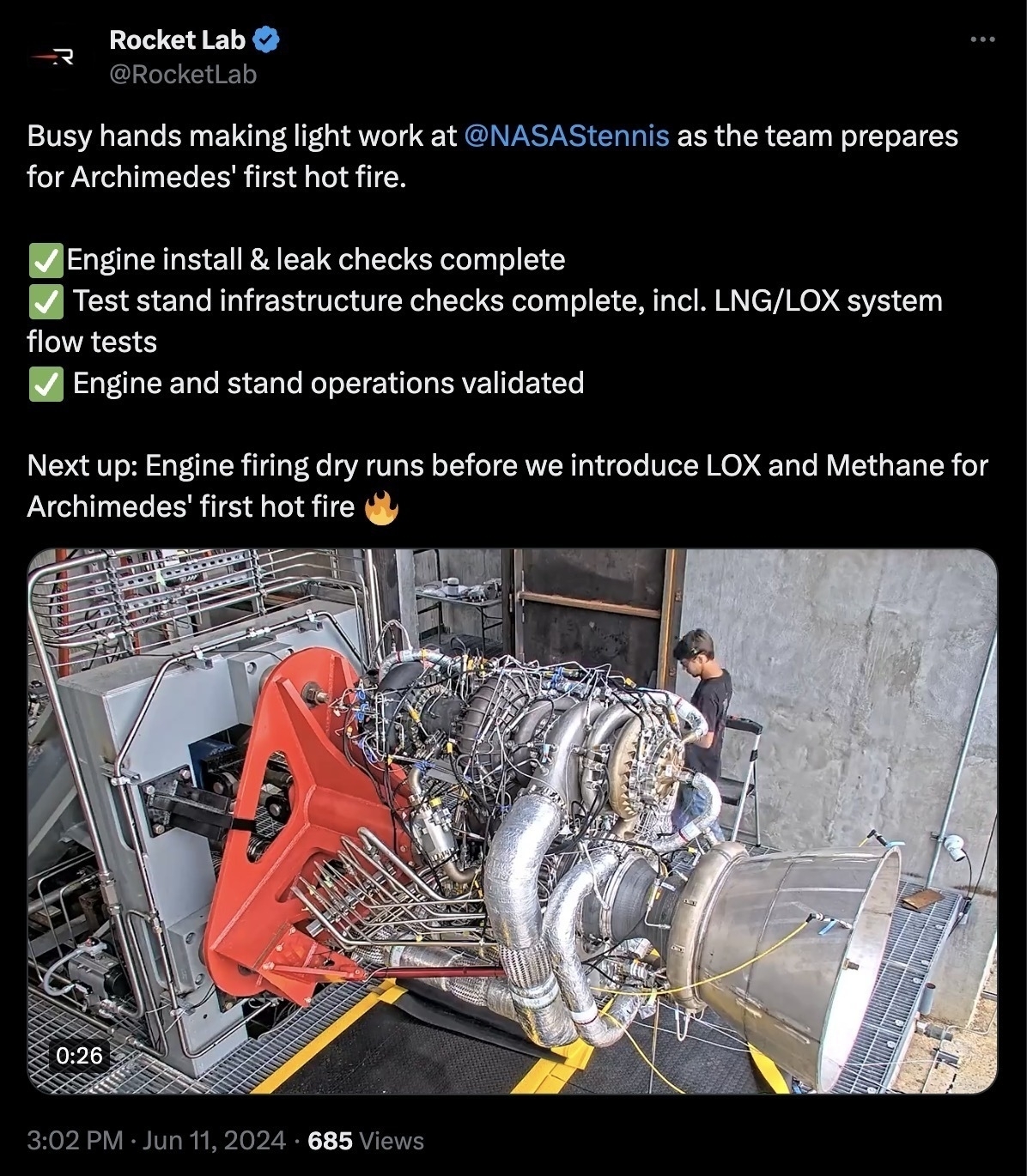

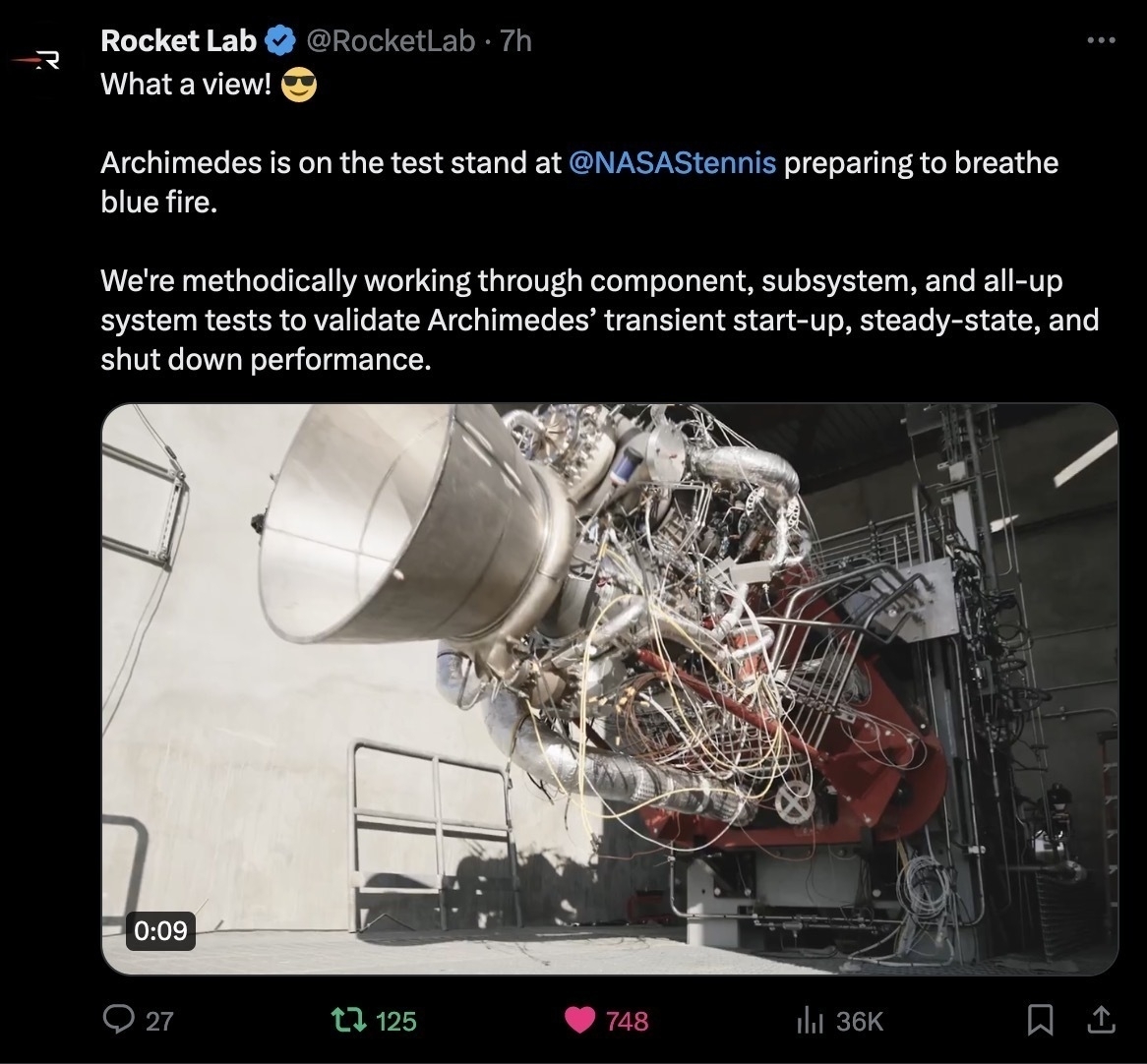

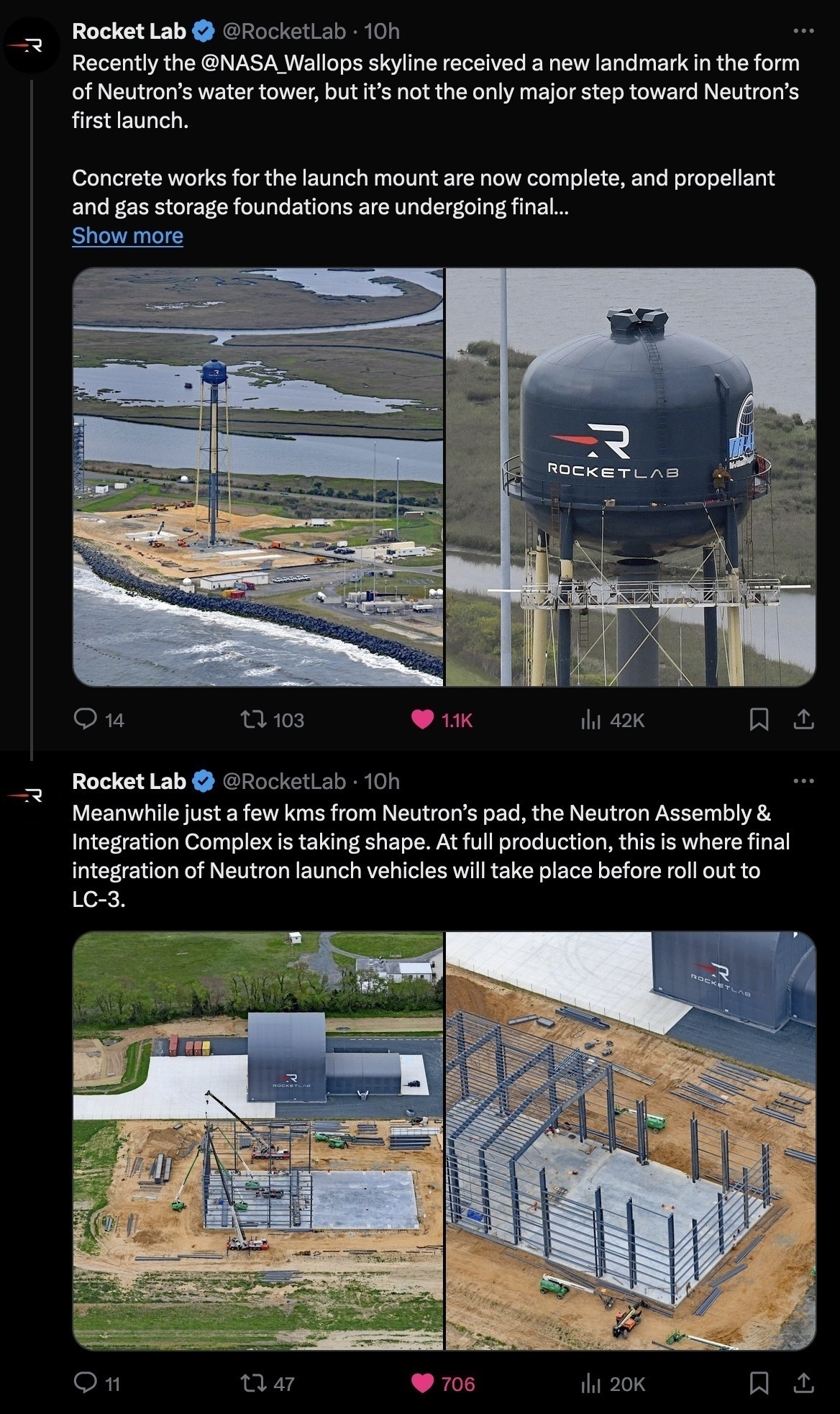

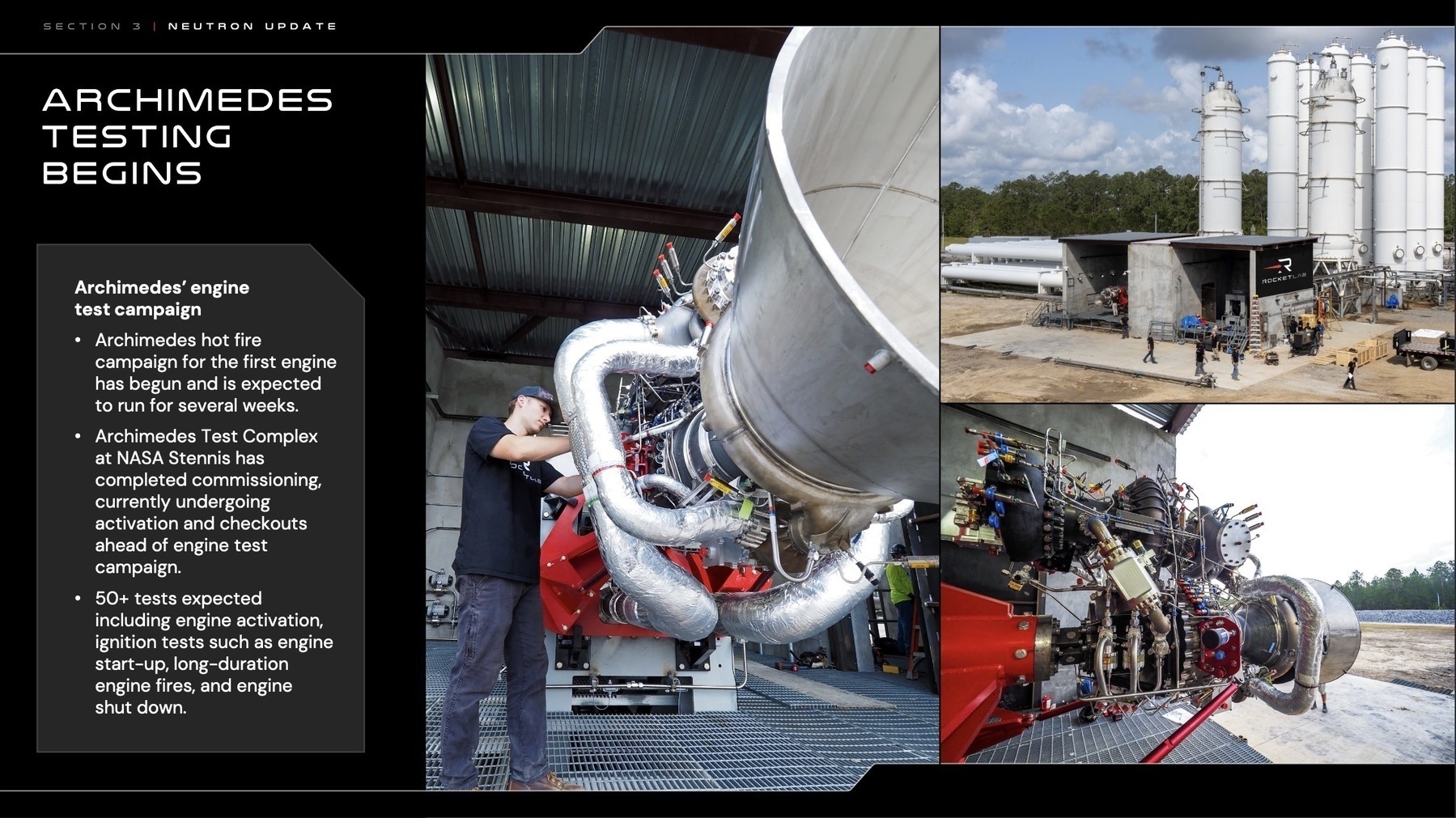

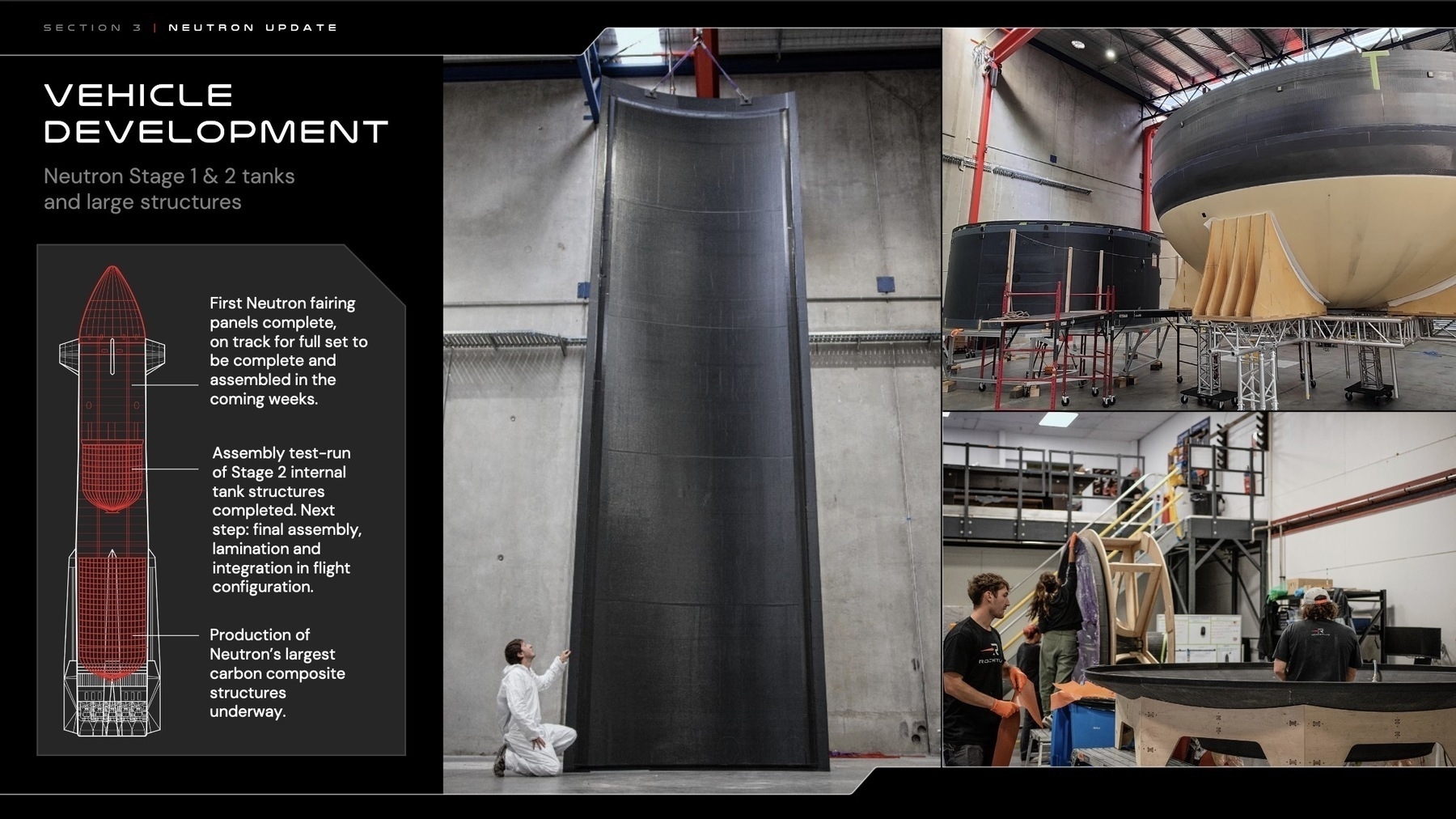

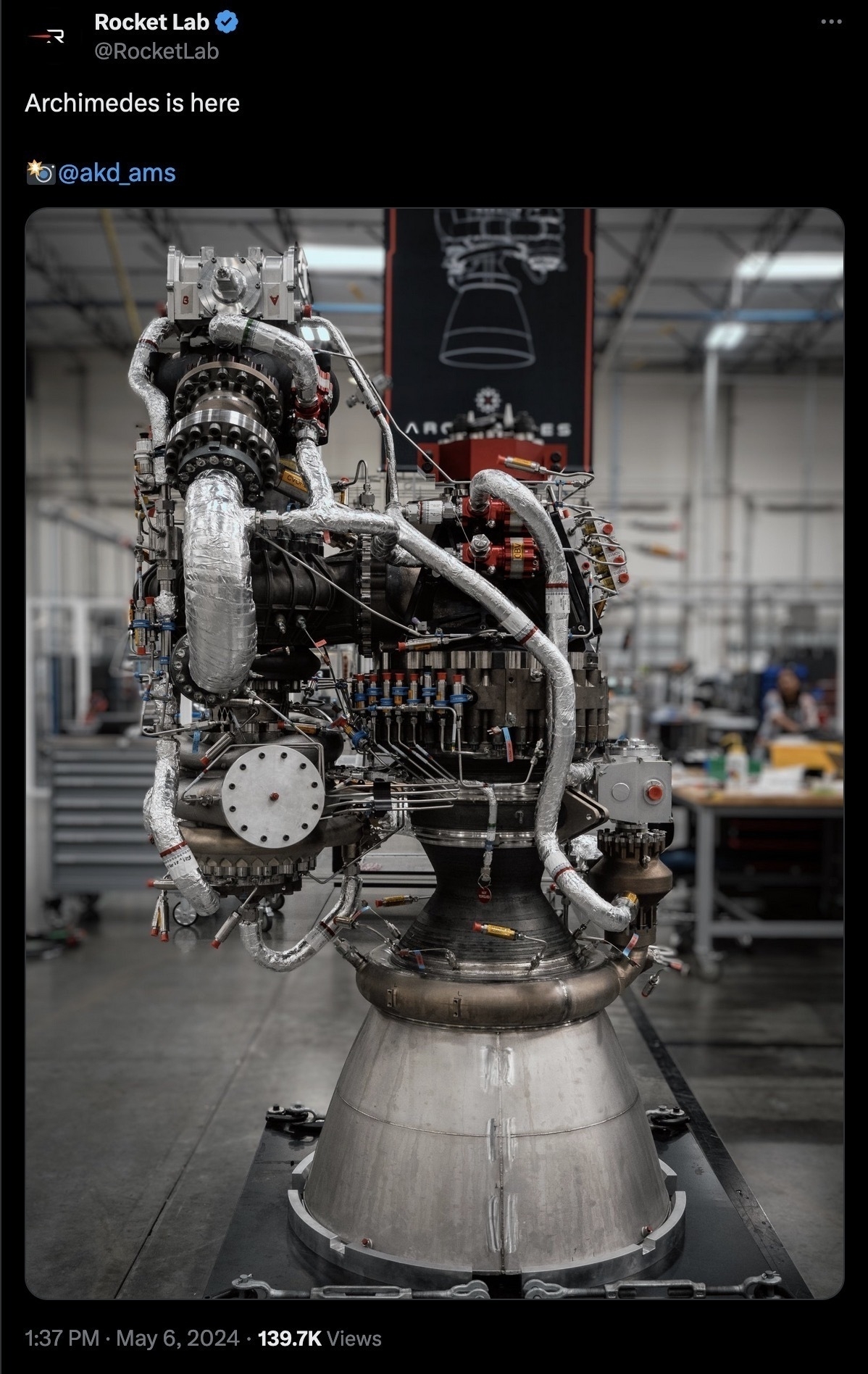

Neutron’s development appears to be on a faster timeline compared to other new medium-lift rockets in development. Rocket Lab reports that flight hardware is in production and qualification for 100% of the vehicle. Key milestones include successful hot fire tests of the Archimedes engine, production of structural components, and ongoing construction of launch infrastructure.

The company’s vertical integration strategy is evident in Neutron’s development, with in-house production of major components and the establishment of automated composite production capabilities. This approach could potentially give Rocket Lab a competitive edge in terms of cost and production speed as Neutron enters service.

Space Systems: A Growing Revenue Driver

Rocket Lab’s Space Systems segment is increasingly becoming a major revenue driver for the company. With over $720 million in contract value for satellites in development, production, and operation, this segment is diversifying Rocket Lab’s revenue streams and positioning it as more than just a launch provider.

Notable achievements in the Space Systems segment include:

-

Completion of twin satellites for NASA’s Mars ESCAPADE mission, showcasing Rocket Lab’s ability to deliver complex spacecraft on time and on budget.

-

Progress on constellation production for major contracts like Scorpius (18 spacecraft for the Space Development Agency) and Thunder (17 spacecraft buses for Globalstar).

-

Introduction of the next-generation Advanced Satellite Dispenser (ASD), demonstrating ongoing innovation in satellite deployment technology.

-

Potential expansion of space solar manufacturing capabilities, supported by proposed federal and state incentives including CHIPS Act funding.

Financial Outlook and Challenges

While Rocket Lab’s revenue growth is impressive, the company still faces challenges in achieving profitability. The Q2 report shows a non-GAAP free cash flow of -$28.3 million and an adjusted EBITDA loss of $21.2 million. However, these figures represent only slight increases from the previous quarter, despite significant revenue growth, suggesting improving operational efficiency. Importantly, Rocket Lab maintains a strong liquidity position with $546.8 million in cash, cash equivalents, marketable securities, and restricted cash at the end of Q2 2024.

The company’s Q3 2024 outlook projects continued revenue growth, with expected revenue between $100 million to $105 million. This guidance indicates confidence in sustained demand for both launch and space systems services. With its substantial cash reserves, Rocket Lab appears well-positioned to fund its ongoing operations and strategic initiatives while working towards profitability.

Conclusion: Positioning for Future Growth in the New Space Economy

Rocket Lab’s Q2 2024 earnings report showcases a company expertly executing its strategy to become a comprehensive space services provider. By leveraging its proven Electron rocket, making significant strides in the Neutron program, and expanding its space systems capabilities, Rocket Lab is solidifying its position as a key player in the evolving new space industry.

The company’s vertical integration approach is a cornerstone of its success, setting it apart from many competitors. This strategy has enabled Rocket Lab to de-risk its operations across both launch and spacecraft manufacturing. The successful development and testing of the Archimedes engine for Neutron, for instance, demonstrates the company’s ability to innovate and control critical technologies in-house.

Rocket Lab’s focus on both launch and spacecraft manufacturing has created a synergistic ecosystem that enhances its competitive edge. As the demand for space-based services continues to grow, the company is strategically positioned to capture a significant share of this expanding market.

The coming years present exciting opportunities for Rocket Lab as it progresses towards its vision of becoming an end-to-end space company. With each successful Electron launch, advancement in the Neutron program, and expansion of its space systems capabilities, Rocket Lab is systematically reducing risks and strengthening its market position.

For industry observers and investors, Rocket Lab’s progress serves as a compelling example of successful strategic execution in the commercial space sector. The company’s achievements highlight the immense potential in building a comprehensive space services business in the 21st century, showcasing how innovative approaches and vertical integration can drive success in this dynamic industry.